October 1, 2025

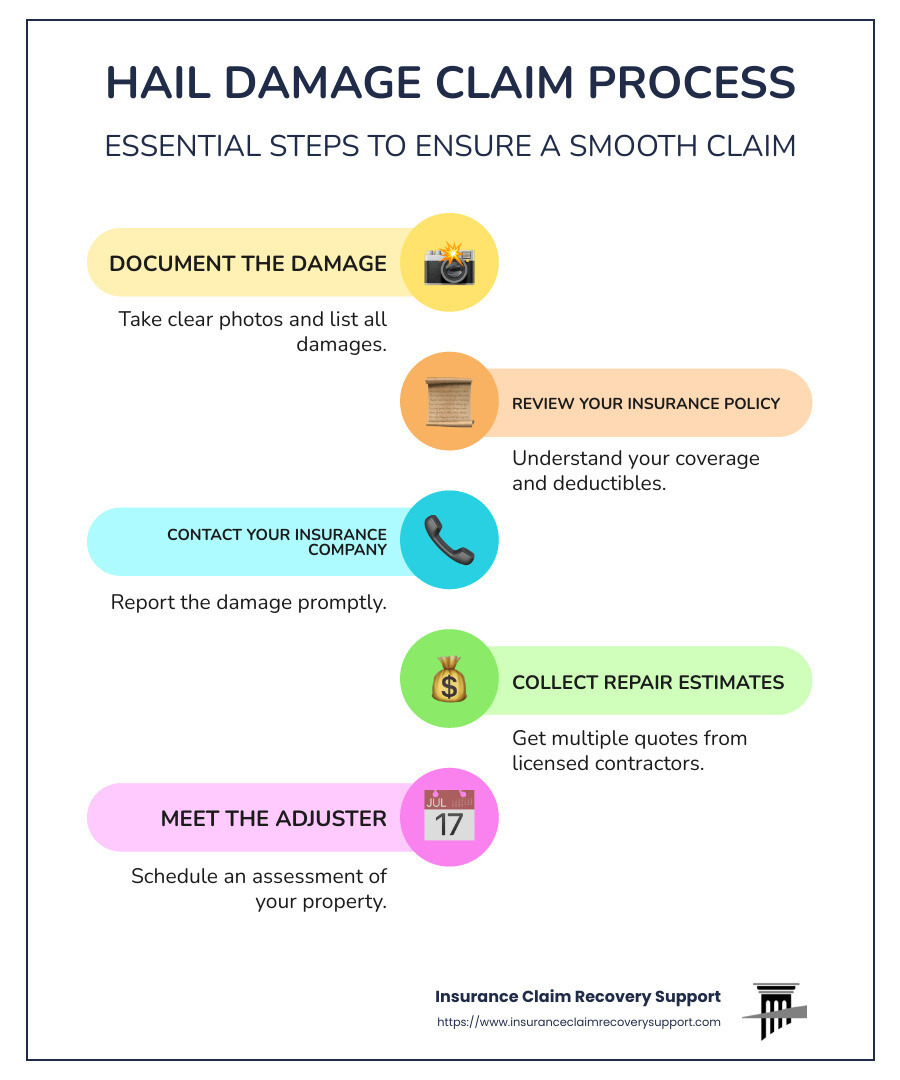

Just How To Submit A Home Insurance Claim: 8 Steps To Filing A Claim

Just How To Submit A Homeowners Insurance Policy Claim: Guide The likelihood of a greater costs rises if you make multiple insurance claims. Protections can differ relying on which carrier and policy you select. As an example, protection for water damage might be tricky and is typically defined with specific restrictions. Talking to your representative or an agent from your firm to see to it you comprehend your plan's protection prior to damage happens may be a great idea. McAllen Property Damage Lawyer

Moore Law Firm - Property Damage & Insurance Attorneys

Top Rated McAllen Property Damage Lawyer

Get A No-cost, No-obligation Testimonial Of Your Home Insurance Case

Afterwards, we cover the remainder of the expense, up to your picked limitations. As soon as you and your insurance provider settle on the regards to your settlement, state regulations require that you be sent out settlement without delay. The quantity your insurer will certainly deduct from your insurance claim payout.What proof do you need for an insurance policy case?

years after a loss or claim will certainly have one of the most influence on increasing your premiums or having a policy non-renewed. The majority of the big insurer in The golden state will not compose a new policy for you if you have had an insurance claim within the last 3 years. Idea 1-- Do not presume NO is final.Tip 2-- Obtain It In Writing.Tip 3-- Currently Inspect Your Policy.Tip 4-- Never Ever Accept Cases Process

Action 7: Get The Case Payment And Complete Repair Work

After accepting a claim, each state has to pay it within a timeframe set by state legislation. As an example, when a case is accepted, the State of New Hampshire has five days to pay the claim. Capture up on CNBC Select's comprehensive insurance coverage of bank card, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to keep up to date. " Storm damages might not raise your costs whatsoever," he stated, "while a burglary or a pipeline bursting can raise your prices significantly." Because of their passion in the residential property as a lender, they may require to validate the funds issued for repayment. Despite the fact that this could be your initial claim, your mortgage and house owners insurer navigate this procedure daily. You can not just sit back and wait on your insurance provider to pay up. You'll have to report the issue quickly, keep an eye on all costs and communicate with the insurance provider to make sure you make money in full for your property owners insurance policy claim. If the offer doesn't properly cover repair work expenses, personal property losses or extra living expenses, you can work out for a far better settlement.- Don't schedule any repairs till your insurance company accepts your insurance claim, nevertheless.

- This process can be mentally tough, particularly if your home has actually endured substantial damage.

- Filing a claim for damages to your home must be an uncomplicated process.

- Whether you submit online or over the phone, we'll lead you via each step and let you understand what info we require.

Social Links