living benefits life insurance

living benefits life insurance milford de

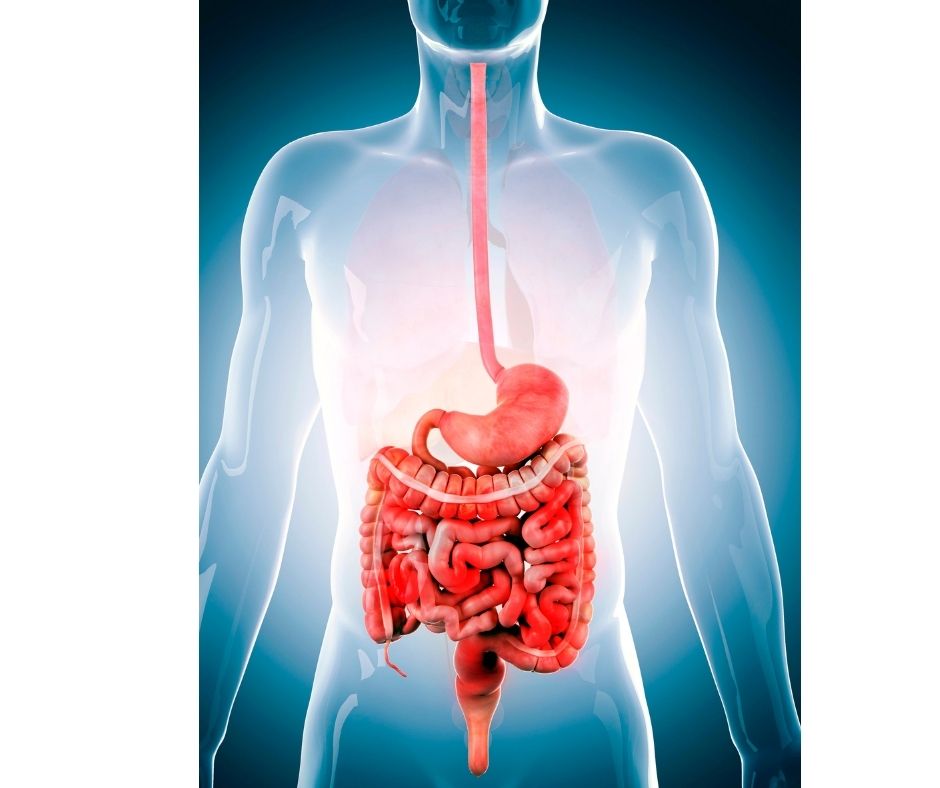

You can only receive a death benefit for long-term care expenses when you are unable or unable to perform two ADLs. The cost of life insurance with an LTC Rider is high and is often called long-term hybrid insurance.

Policy surrender. Policy surrender is when your permanent life policy is canceled, and you can access the cash portion in a lump sum. The amount you receive from the insurer, less any outstanding loans or unpaid Premiums, will be deducted.

Some policies allow you to access cash value and accelerate your death benefit while you're still alive. These are often referred to as "living benefits" and may be the most well-kept secret in life insurance. You might find yourself in unexpected situations, so having an additional source of income could be a great help.