does homeowners insurance pay off mortgage if you die

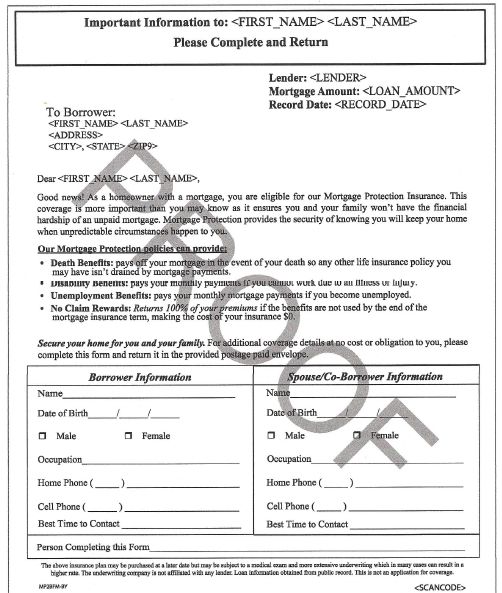

Most of the offers you receive in the mail have a postage-paid response card enclosed. Life agents know they will receive a response rate of approximately 2% to 3%. The next step is to call you and schedule an appointment. Be very careful here. Most mortgage life agents are trained to sell you in one visit. It's called the "one-call close." Be prepared for a compelling presentation. However, insist that the agent leaves the quote with you. Take time to compare it to your other options. Tell them this is a big decision and you need time to shop and consider other companies.